Saudi Budget 2017 is first budget after announcement of Vision 2030, there many things such as tax, Vat, Remittance tax may be implemented on expats under the provisions of Vision 2030. In budget of 2016 Saudi Arabia cuts spending to reduce the deficit hence takes measure to increase such as hike in visa fee and cutting of allowances of Ministers due to which budget 2017 is less suffered.

According to Saudi Finance minister Saudi Arabia tries best to to increase non-oil revenues. From year 2015 to 2016 government introduces reductions for both expatriates and Saudi Citizens such as increase in oil, fuel, and utility prizes, visa fee hikes etc. Which helps the Saudi Economy for steady growth while reducing budget deficit. If these measures were not taken the kingdom’s foreign reserves will be vanished until 2021.

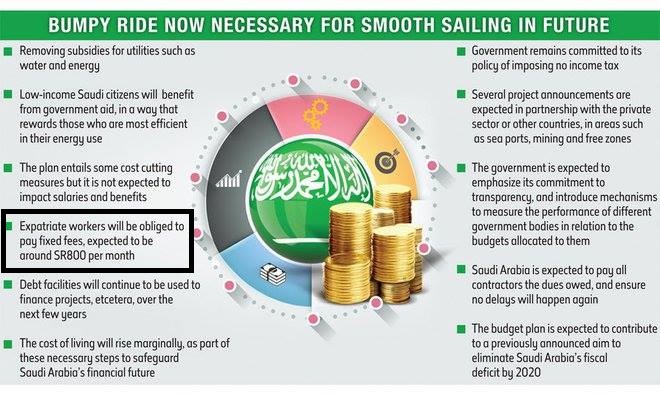

Saudi Budget 2017 and its effects on expatriates:

In budget 2017 it is proposed for expatriates to pay monthly fee of SR 100 for each dependents under them as well as sponsor person himself. Means if you response 3 family member than expatriates need to pay 300 SAR on monthly basis. From this Tax Saudi Arabia will generate Revenue of 1 billion.

This is not it after the year 2017 new year will also not good for expatriates which is 2018 in which A monthly tax 400 Saudi Riyal must be given by sponsor, employer, companies in case if expatriates workers are more than Saudi Workers. Which severely impact on Hiring of expatriates as employer will try to hire more Saudi expatriates due to which they fire or terminate more and more expatriates to reduce their spending.

Image Source ARAB NEWS

Also if Saudi Employees are more than expatriates employee companies have to face 200 Saudi Riyal tax for each worker. This tax generate revenues up to 24 billion but this might become false if expatriates start to exit from Saudi Arabia. There are many new measures which have been taken to increase revenues especially for expatriates.

No worries for Expatriates Domestic Worker Drivers maids, cleaners as these fees are only applicable to expats working in commercial organizations.

Leave a Reply