QNB Bank Personal loans for your needs and aspirations. What ever your Goals are Qatar National banks helps financing with personal loan which provides you all necessary support to achieve them. Your desires could be fulfilled using Qatar national bank personal loan if you salary is only 2000 QAR You could go to you dream locations for vacations, providing higher studies to children, celebrate occasions, medical treatment from loans.

The thing you have to do that only apply for Qatar national Bank Personal Loans.

For Qatari Nationals the personal loan requirement is minimum 2000 QAR salary while 6000 salary required for those working in Qatar as an expatriates. Salary transfer in mandatory in Qatar National Bank Personal Loans. One of the major benefit of QNB personal loan is that they provide best interest rate as compare to others.

Types of Personal Loan in QNB:

Personal Loan Against Fixed Salary:

Personal Loan against Fixed Deposit:

You can get the loan you need but have to maintain fixed depost and accruning profits. Using A QNB personal loan against fixed term deposit, you get cash up to 90% of you fixed deposit money with having lowest interest rates. The appliccation requires ID.

IPO Loans: IPO(Initial Public Offering) This personal loan helps to gain momentum in Stock Market whether you are a starter or experienced stock market investor. The IPO loan is best for your interest.

Flexible Facilities

Top Up Loan: if you didn’t pay your loan we still offers you to top up you account quickly easily.

Loan Transfer: Transferring of Salary to QNB is easy with QNB personal loans. QNB pays all related fee regarding transfer of salary and other liabilities.

Early Repayment: No worries for time. Pay us full and partial at any time with no fee.

Grace Period: 3 months period grace period is given which means Get your loan today and start payments after three months.

Postpone Loan Installments: Postpone 2 loans installments per year in case of you could face emergency.

QNB Personal loan Eligibility and Interest Rates

Personal Loan amount for Qatari Nationalist

Loan Amount including interest 2,000,000

Tenure up to 72 months

Minimum monthly Salary for Qatari Nationalists is 2000 QAR

Debt Burden Ratio 75%

Personal Loan amount for Expatriates:

Loan Amount including interest 400,000

Tenure up to 48 months

Minimum monthly Salary for expatriates is 6000 QAR

Debt Burden Ratio 50%

Fees and Interest Rate:

Amazing competitive interest rates

Clearly display all rates and fees show transparency

No fees

Special offers for retired Qatari citizen as well as for those who transfer their salary and liabilities to QNB Account

Services and procedure facilities

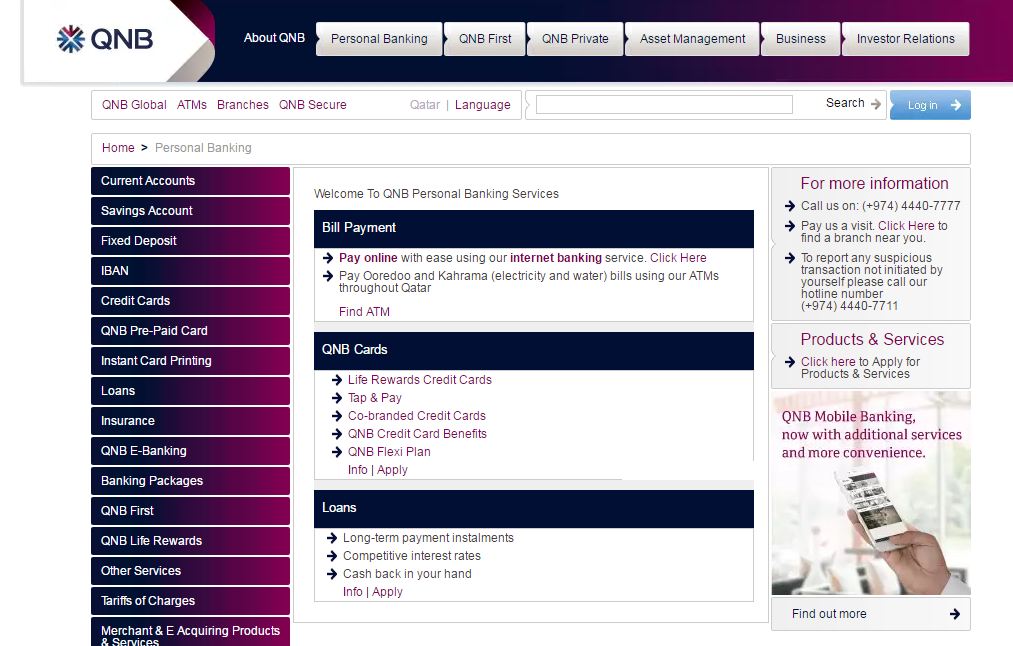

The procedure were really simple if all requirement competes Loan will be given with 24 hours. Trained sale agents visit you at your convenience. You could also apply through online QNB website. QNB has largest atm and branches networks throughout Qatar. Mobile applications support different options to communicate and respond to queries.

Required Documents for Application of Loan in Doha Qatar:

Required Documents for Qatari Nationalists:

Valid ID and Salary certificate

if Transferring Liabilities to QNB Liabilities certificate from current bank is required

Required Documents for Expatriates:

Valid ID and Salary certificate Valid Passport

if Transferring Liabilities to QNB Liabilities certificate from current bank is required

- Visit Our website qnb.com

- Our internet and mobile applications.

- Contact our Customer Care Centre on 44407777

- Visit your nearest branche.

- Apply Online from this link

I NEED 10000 QRA LONE

Attention:

Looking for a highly original loan? At an affordable interest rate? Processed within 2 of 5 working days. Have you been turned down constantly by your banks and other financial institutions? Moorgate Finance offer loan ranging from 5,000.00 min. to 50,000,000.00 Max. Minimum interest rate of 2%. Contact us via our email: moorgatefinance01@gmail.com for more information.

Thanks.

Do you need an urgent loan??? Are you in Debt? Do you have bad Credit? Do you need a loan? We give out loans to People despite their poor/bad Credit scores. We give out both business and personal loans with long and short term duration of your choice. Our loan programmer is fast and reliable, apply today and get instant feedback.

Our loans are ranging from a minimum $5,000.00 and maximum of $100,000,000.00. Our loans are well insured, 100% Guaranteed and Clients are assured maximum security. For further inquiry contact us via our email address: Eplcrownfindsolution@mail.com

my salary QR 4500 I need personal long